Why do people visit Las Vegas?

LAS VEGAS, Nevada - As reported by Jennifer Robinson, Gaming Wire: They're the big questions among local operators in gaming and tourism.

Why do people visit Las Vegas? Why do they return? Are the

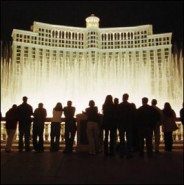

Crowds gather nightly to view the Bellagio Fountains city's hotel rooms and restaurants getting too expensive to sustain growth in the market? Will rising travel costs keep consumers away?

A nationwide telephone survey conducted in December and January by research firm MRC Group for the Review-Journal provides some answers: Consumers' reasons for visiting Las Vegas continue to evolve, and pricier rooms and meals aren't yet keeping them away. However, constricted capacity at local airports could emerge as a deal breaker for tourists on the fence about paying Sin City a visit.

First, let's start with why those tourists continue to flock to Las Vegas.

For 45 percent of visitors, the primary reason for coming to Las Vegas was for leisure time. Fourteen percent came to town for a convention or business meeting, and 6 percent came primarily to gamble.

Though a small number traveled to Las Vegas expressly for gambling, 84 percent of visitors said they gambled while here. Other popular activities included eating at fine restaurants (79 percent), filling up at buffets (64 percent), sightseeing on the Strip (63 percent) and shopping (62 percent). Production shows were popular with 45 percent of tourists, and 29 percent went on sightseeing treks off the Strip.

Jim Medick, chief executive officer of MRC Group, said the new numbers reflect Las Vegas' ongoing transformation into a diversified destination. For example, MRC's first consumer surveys a decade ago showed that about 5 percent of Las Vegas tourists were coming for conventions, while 75 percent were traveling here mostly to gamble.

"As the city has turned slowly into a full entertainment complex, the primary reason people now come is for entertainment," Medick said. "The beauty is, 86 percent of visitors still gamble, which is our primary source of revenue."

Added Bill Eadington, director of the Institute for the Study of Gambling and Commercial Gaming at the University of Nevada, Reno: "Las Vegas has developed a different reputation. Twenty years ago, the city's reputation was still somewhat questionable morally. It was Sin City, and a place for gamblers. Now it's evolved into a corporate playground."

Medick said the city's wider variety of attractions is also generating return visits, with most respondents saying they planned to come back to Las Vegas for future trips.

"The first time people visit, they have a lot of different things they want to do, but they find out they can't do it all," Medick said. "The second time, they can fit in some of the restaurants and attractions they didn't see the first time."

Among those who have been to Las Vegas once in the last two years, 70 percent said they would come back. That rate jumps to 86 percent for tourists who have visited twice in the last two years and 100 percent for those who traveled here four times in the last two years. The return rate falls slightly to 99 percent for respondents who made 10 trips to Las Vegas in the last two years.

Medick said a return factor of 50 percent is considered "very good" in the travel industry.

Asked why they'll boost their number of trips to Las Vegas, respondents mostly said they enjoyed a "good time" while here. The quality of restaurants came in second, and several respondents said they'll come back to the city because they bought a condominium here.

But some consumers plan to shed visits to Las Vegas, and their reasons for coming less often speak to big concerns among industry watchers: competition and price.

Overall, 7.5 percent of respondents said they will travel here less in coming years because Las Vegas is getting "too expensive" and Indian casinos allow them to gamble closer to home. Those who said the city is too expensive cited rooms (32 percent), restaurants (23 percent), shows and entertainment (21 percent) and travel costs (13 percent) as their key budget busters.

Eadington said several dynamics are propelling the upscaling of Las Vegas.

First, the 1989 opening of The Mirage, as well as corporate consolidation, encouraged and allowed operators to ditch the loss-leader strategy whereby they lured customers with restaurants, buffets and entertainment at discounted prices and made up the missing profits via casino revenue.

What's more, increasing business travel into the market has translated into more customers on generous expense accounts, Eadington said, and conspicuous consumption among leisure travelers has created additional demand for higher-end offerings.

Those pressures have combined to "squeeze out the ability to stay at a top-tier Strip property at what used to be phenomenally low prices," Eadington said. "You can still find bargains, but it's much harder now that Las Vegas is running at near-full capacity and consolidated casino companies are looking much more at every division as a profit center rather than a loss leader."

A new wave of planned construction likely won't pare Las Vegas room prices.

Encore at Wynn Las Vegas and the Palazzo adjacent to The Venetian will combine to deliver more than 5,000 high-end rooms to the Strip by 2008. MGM Mirage's $7 billion Project CityCenter will bring the tony Mandarin Oriental brand to Las Vegas, and officials at Boyd Gaming Corp. are negotiating with operators of posh boutique brands for the company's $4 billion Echelon Place, which will be under construction on the Stardust site in 2007.

"Las Vegas will slowly lose the lower end of the demographic scale when it comes to household income," Medick said. "There will be a point when they just can't afford to come here anymore. The room that used to be $50 is now $100, and there will be people who say, 'We can't do this any longer -- it would be better for us to go see an Indian casino or riverboat closer to home.'"

Analysts said higher prices aren't a bad omen for Las Vegas.

The proliferation of casinos around the country was destined to siphon off lower-budget travelers, Eadington said. The market segments that remain for the city are more affluent.

"To the extent they can afford to stay at five-star hotels and experience the shows and high-quality dining, (high earners) are a very desirable customer," he said.

Medick agreed.

"In a way, you never like to lose any part of your market, but in Marketing 101, you would rather market specifically to the most profitable segments, and that would be segments with higher disposable incomes," he said.

David Schwartz, director of the Gaming Studies Research Center at the University of Nevada, Las Vegas, said pricier rooms are not necessarily at odds with the value customers perceive in the local market.

"A room at the Four Seasons for $150 could be seen as a better value than one at the Comfort Inn for $75, even though it's twice as expensive," Schwartz said. "It all boils down to consumer choice: Do visitors want to pay less for no-frills rooms in older properties, or do they want glitzier, newer accommodations?"

And for the foreseeable future, a variety of lower-priced hotels off the Strip and downtown will help fill the needs of consumers seeking less-expensive rooms, Medick said.

Rising room prices aren't the only factor that could stifle growth in visitor volumes in coming years.

Medick said the proportion of respondents concerned about travel costs (13 percent) was slightly higher than in recent years. He attributed the increase to higher airfares rather than rising gasoline prices, and suggested that congestion at McCarran International Airport could take the biggest toll on Las Vegas' fortunes. In January, McCarran officials said they would reach the limit of their expansion abilities in 2011, when they open Terminal 3 near Russell Road. A supplemental international airport in the Ivanpah Valley is unlikely to open before 2017.

As available capacity at McCarran dwindles, ticket prices to Las Vegas could increase.

"If there's one flaw in our model, it's capacity at McCarran," Medick said. "McCarran needs to grow significantly to meet the demands of the market. More people will want to come here, and we're going to need great airfares and places for these planes to land."

Las Vegas has run up against many competitors looking to cash in on the lucrative gaming industry.

And while some competing venues have gained market share at Las Vegas' expense, others have simply increased the pool of gamblers available to the entire industry.

Jim Medick has no doubt Indian gaming has affected gaming numbers in Las Vegas.

"We are losing dollars to Indian gaming," Medick said. "We're not seeing a revenue impact because of higher prices (in Las Vegas) and because the overall pie is so much bigger that we've been able to continue to grow. But the money that's going to Indian casinos is coming from somewhere. It's coming from Las Vegas' pocket."

Medick estimated that local gaming revenue would be 5 percent to 8 percent higher each year if tribal gaming didn't exist.

A survey written by the Review-Journal and compiled by MRC Group confirmed that some Sin City customers are swapping visits to Las Vegas for treks to their local tribal concern, with 27 percent of respondents saying they have made fewer trips to Las Vegas since they started playing at Indian casinos.

Balancing that, however, is a virtually equal number of survey participants -- 24 percent -- who said they are traveling to Las Vegas more often since they started playing at Indian casinos.

So like Atlantic City before them, Indian casinos have reduced trip frequencies to Las Vegas among some consumers at the same time they've expanded the overall universe of gamblers.

"The Indian casino can never replace Las Vegas," Medick said. "Indian casinos are great places to get a little gaming going on, to have a little dinner and have fun locally without driving or flying out here. But the truth of the matter is, Indian casinos are good training grounds for people who want to come to Las Vegas. Consider the major leagues and the minor leagues. They trade players back and forth, but everyone wants to play in the major leagues."

The survey results indicate that Internet gambling is also growing the ranks of prospective Las Vegas customers.

Among participants who said they gamble online, 17 percent said they are coming to Las Vegas more often since they began playing electronically, while 8 percent said they are visiting Las Vegas less.

Medick said Internet play appeals mostly to adults ages 21 to 35.

"The Internet is introducing some of the younger generation to gambling, especially through poker Web sites that allow you to play poker with people around the world. It also introduces them to new games, and it encourages them to want to come and try the real deal in Las Vegas," he said.